*Based on the premium rates of our low mileage policy. Actual savings may vary depending on individual circumstances and coverage selections.

Receive free car insurance quotes online in under a minute with the price that’s right for you.

1. Your car details and main driver details

Enter your car’s make, model, and your personal details to get started.

2. Your driving history

Provide your claim history, mileage, and driving habits. Mention any no claims discount you have.

3. Compare and choose

Instantly review quotes to find the perfect coverage at the best price.

We guarantee great customer service. Here are some of our unbiased, third-party customer reviews

Very good service and fair price I am highly recommended this company to anyone who looking for car insurance

Trusted Customer

01/02/2024

4.9/5

Certified by Feefo.com

This is the most comprehensive cover you can get. It covers you for:

This covers you for:

This is a fairly comprehensive plan. It covers you for:

This covers you for:

This is the most basic voluntary cover. It covers you for:

This is required by law and covers:

This is tailored for electric vehicles and covers:

| Coverage details | Car Insurance Type |

|

1

2+

3+

2

3

Por Ror Bor

EV

|

*Depends on the conditions of each insurance company.

*Additional coverage can be purchased from the insurance company.

Free quotes

Get free car insurance quotes without providing your contact information upfront or dealing with pushy sales agents.

Wide comparison

Compare insurance from 16 different companies and customise your policy by choosing your desired sum insured, instalment plan, deductible & more.

Customer-centric approach

We prioritise satisfaction, proven by our 4.9/5 customer review score. Happy customers are more likely to return and recommend us.

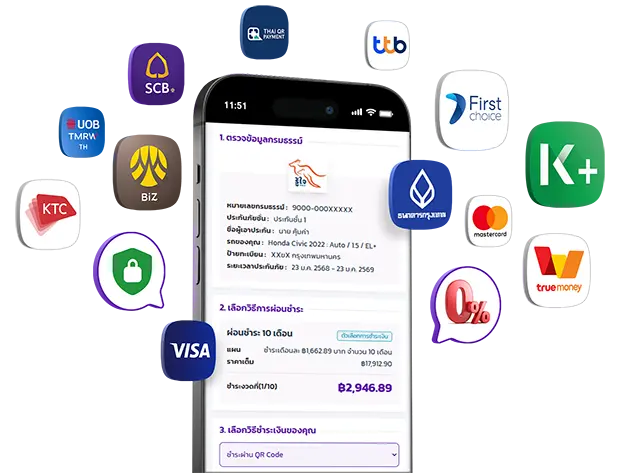

At MrKumka, paying for your auto insurance is simple and hassle-free. Once you’ve purchased your car insurance, our agents will contact you to confirm the details and assist with any questions.

Choose from a variety of convenient payment options to suit your needs:

Yes, you need car insurance in Thailand. It is mandatory to have at least compulsory insurance, known as Por Ror Bor. This insurance provides basic protection for accidents involving pedestrians, drivers, or passengers, covering injuries and deaths. Without it, you cannot legally operate a vehicle on Thai roads.

Additionally, you can opt for more comprehensive coverage through voluntary insurance to protect yourself and your vehicle.

Why are more people choosing MrKumka for car insurance in Thailand?

According to our data, car insurance policies in 2024 saw a 25% increase in growth compared to the previous year. This surge is largely thanks to platforms like MrKumka, which helps users search for affordable premiums, compare coverage, and pay with convenient payment methods with just a few questions.

While most customers are based in Bangkok, more and more customers from provinces are buying car insurance due to the competitive pricing that we offer. Provincial customers grew by 16%, while customers in Bangkok increased by a notable 50%.

-Supinya WuttitrairatInsurance Expert

MrKumka works with leading insurance providers in Thailand, trusted for their reliability and customer service. Here are some of the top companies we partner with:

You can easily check your car insurance quote on MrKumka, customise your policy coverage, and enter your details to proceed with the purchase. If you prefer, you can also give us a call at 02 080 9292.

Learn more on how to buy car insurance with MrKumka

Enjoy the convenience of a remote video or photo car inspection by easily sharing your footage with our agents. After purchasing your car insurance on MrKumka, our agents will contact you with inspection details and keep you updated on the approval status. For an in-person car inspection, please call us at 02 080 9292.

Each insurance company has its own claims process. Generally, you should contact your insurer right after an incident and collect all necessary information (photos, details, witness contacts). Follow their instructions, which might include filing a police report and having your vehicle inspected. Submit all required documents so your insurer can process the claim and update you on the outcome.

Reach out to us at 02 080 9292 if you need help with a quote for a car or have any other questions or concerns regarding car insurance.